Credit Unions’ Powerful Role in Latino Financial Education

In Latin American countries, the concept of financial education is not taught in schools nor by financial institutions. If you were to scroll through the website of a Latin American Bank it will probably take you some time to find a link to an educational portal or blog. It’s rare to find financial literacy programs, even at the very same financial institutions that provide checking, savings and loans. Most Latinos learn the process of buying a house or a car from their family and friends and then use their best judgment to make their financial decisions. Hispanics who move to the U.S. encounter different types of problems when it comes to financial education. For most Hispanics, the U.S. dollar is a new currency, so that learning curve confronts them along with the inevitable exchange-rate math they do in their head when buying goods or making big purchases. The very basics of financial education are a necessity that credit unions are primed to provide as part of their service to the Latino community, which is ripe with young, tech-savvy new potential members who make recommendations to their friends and family. Outsourcing your Hispanic marketing efforts to experts who understand the nuances and cultural mores is often your best bet. Discover more about YMC’s Hispanic marketing here and don’t hesitate to reach out to me to learn more. Latinos will take the time figure out if the money they’re spending to purchase goods would be too much to spend instead of sending some more back home to help their families. As community-based cooperatives, credit unions can help Latinos feel at ease knowing we won’t take advantage of them. Credit unions can help them understand how the U.S. dollar works, how the American financial system works and how to budget for their needs through educational and marketing efforts. Banking and budgeting are challenging for a lot of people no matter where they’re from. Imagine how someone who comes from another country and has very little knowledge of financial institutions feels. Latinos are fearful of walking into banks to establish financial services relationships. Managing money is intimidating, but especially when you don’t fully understand the banking system and the language barrier may prohibit you further. Credit unions can differentiate themselves by providing vital financial tools and resources for Latinos to learn the American banking system, implementing outreach programs, sharing educational and marketing materials in print and online – and in Spanish, and allowing members to schedule one-on-one conversations. Highlight the benefits and show them how to best use the products or services your credit union provides for their particular situation. And ensure your credit unions’ products and services meet their needs, such as international wire transfers, credit building tools and, of course, financial coaching. One of the most important components of financial coaching is education around the prudent use of credit to build wealth. Credit is a new concept for most Latinos, so it’s extremely important to focus on debt and its proper management when marketing to Hispanic consumers. It’s a complicated subject, but credit unions are the experts! We can help build wealth and empower Latinos to conquer their American Dream. When credit unions make a genuine effort to implement authentic financial coaching programs to help Latinos learn and understand the U.S. financial system, they can make better educated decisions, live with less stress, and regard your credit union as their trusted financial partner. They’re an optimistic culture, so market and educate to their ideal selves. Financial education is an integral part of credit unions’ core values. As community-oriented, not-for-profit financial institutions, credit unions can distinguish themselves by educating all of our members, including the Latino market within your field of members, and ensuring members fully understand the products and services your credit union is providing. Scroll down and fill out the form to receive a free copy of our Hispanic Marketing teal paper to learn more.

Hispanic Marketing in 2020

Why your effort and time trying to reach the Hispanic market is not working Hispanics account for the fastest and largest growing community in the United States according to Snapshot of the U.S. Immigration in 2019 by the National Conference of State Legislatures (NCSL). The Hispanic market has enormous untapped business potential and it represents one of the biggest opportunities for credit unions’ membership growth. Nevertheless, it has been overlooked by financial institutions as it is also one of the most underserved communities. Companies that have strategies in place to connect and attract Hispanic consumers to utilize their products and/or services are seeing success. However, most credit unions are failing to reach this demographic due to lack of cultural knowledge, failing to build trust with members, and overlooking the need to hire bilingual staff in branches. Many companies, including financial institutions, have seen potential in the Hispanic market and are looking for ways to serve this market while meeting their goals and grow. Companies that see this potential have made moves to translate marketing materials to increase their appeal to the Hispanic market. While this is a great start, your efforts could be for naught if you are simply translating material without a strategy to serve these new members. The resources you delegate to reach this market should meet the needs of the Hispanic community and be appropriate for their culture and diverse background. When not implemented correctly, Hispanics will drift away, and this could possibly generate a bad reputation for your credit union because you fail to understand their needs. When interest increases from the Hispanic community for your credit union’s products and services, you have to ensure they receive the personalized service and exceptional member experience that credit unions are known for. In order to accomplish this, it’s imperative that you have staff that are fluent in Spanish and English in branches with a high Hispanic population as some members would feel more comfortable discussing their finances in Spanish. In implementing bilingual staff members, you will be able to knock down barriers to entry and will make huge strides in effectively serving the Hispanic market. In addition to offering services in Spanish, it is equally imperative that your staff relate to and understand the unique challenges your Hispanic members face. The staff you put in place to service the Hispanic demographic should be able to relate to the many life stages and backgrounds of these members. For example, associates who migrated to the United States will understand and empathize with your first-generation Hispanic members better than someone that only speaks Spanish but does not fully understand the culture, struggles, and achievements of someone who migrated to the U.S. Your staff should be able to relate and provide excellent member service by helping them understand and navigate this new financial world. It’s important that you make them comfortable enough to share their struggles and begin to trust you as their primary financial institution. Member service is one of the most powerful and valued aspects of any credit union, but it is not enough to ensure loyalty from your members. Any successful financial institution must be able to meet its clientele’s financial needs. Therefore, providing the right products and services is as crucial for the Hispanic market as it is for any other client sector. According to the 2016 U.S Census almost 23 percent of the Hispanic population in the U.S. are noncitizens and might not have a social security number. This prevents them from taking full advantage of all the benefits offered by financial institutions in the United States. Credit Unions need to understand the importance of providing products and services that will help and educate this community. For instance, offering memberships and loans to Hispanics with Individual Taxpayer Identification Numbers (ITIN) is imperative to help this community grow and reach financial stability. Finally, financial education should be a top priority as many Hispanics are navigating finances in the United States for the first time and the way credit and other financial services work in the U.S. is very different from other countries. This creates frustration and stress as many of them arrive as adults and building credit will take some time and effort which will delay achieving their financial goals and fulfilling their “American dream”. Like any other marketing efforts, reaching the Hispanic market can be frustrating if you are not prepared. However, with the right strategy and implementing the tips mentioned above, you can successfully reach this community and build strong relationships.

A Time to Reflect

A Time to Reflect on 2019 The start of the year is a great time to evaluate what we accomplished in the past year and what we hope to achieve in the new year—or in the case of 2020, the new decade. As a participant in the Future Leaders of YMC program (FLY for short), I am taking the time to count my blessings for the people I work with. Our FLY project began last year with a goal that was both simple and ambitious: to achieve a healthy work-life balance. That was a pretty tall order. As our group looked at all the possible ways to accomplish our goal, we narrowed down the options and decided to create a set of best practices that would allow any team member to take a vacation or time off from work without the pressure of checking email and staying in touch while they’re gone. For a boutique firm with highly dedicated team members, completely unplugging from work was a foreign concept. We began our plan by interviewing each team member to define the best practices for their respective positions and platforms. The first step was successful. Then, as we asked additional questions about communication and how other team members could make their job easier, we found some hidden treasures. The conversations opened an endless stream of ideas, uncovered opportunities to become more efficient, and, most importantly, allowed each staff member to feel heard. Interestingly, none of my coworkers’ insights focused on what would make their life easier. Instead, their feedback provided ideas that could make the team more efficient or more intentional. Some team members even saw opportunities for how they could bring more creativity to our larger projects. These insights were incredibly helpful and allowed us to make quick changes that had an immediate impact. Now, almost twelve months after starting the process, we are putting the bow on top of our best practices for every platform and position within our company. We’ve even been able to develop procedures and expectations for roles we hope to add in the future. We stored these documents electronically in one location, giving everyone on the team equal access to the information. New employees can easily reference what is expected of them, and existing staff members can see the expectations for positions that may interest them in the future. To ensure consistency throughout our company, our team leaders will incorporate the best practices into weekly check-in meetings, as well as our full staff meetings. Our best practices are not so much rules that restrict how we work, but guidelines that keep us focused. This distinction was important, and as we discussed it, I couldn’t help but think of the pirate code from The Pirates of the Caribbean. That code was more a list of suggestions than a collection of rules. Defined processes may sound boring, but they hold great value for any organization working towards consistency. In 2019, YMC decided to focus on improving three key areas: Quality, Consistency, and Calm. By establishing our best practices, we made great strides toward our goal. If you’re a leader interested in creating an environment where every staff member feels valued and your team operates at its full potential, I recommend taking a look at your best practices. If they’ve been forgotten and relegated to a massive binder on someone’s shelf, it’s time to dust them off. If you haven’t looked at them in a while, there’s a good chance your guidelines aren’t communicating your procedures and expectations as clearly as they should. Updating your best practices can help you build a strong culture of accountability and collaboration. One final word of advice: If you decide to refresh your best practices (or maybe even establish some for the first time), I encourage you to ask your team for perspective—and really listen. Many times, the most innovative changes come from unexpected places.

New Ways to Add Value for Your Membership

I’m kind of an app freak. Well, really, I am a rebate, savings, make some money on the side app freak. I love them. My obsession began a few years ago when I was trying to do a “fun apps to help save you $$” newsletter article. I downloaded, tested them, hated some, loved others. I scanned bar codes, receipts, clicked through to sites from the apps to earn some percentage of my purchases. Saw some become obsolete or consolidated and of course new improved, more innovative, easier to use ones crop up. Years later I still love them. I have my three favs currently and….more importantly….my kids LOVE THEM! Ok. So, moms and dads out there… this blog’s for you. “Mom, can I have $? I’m going to the mall.” “Mom, this month’s Ipsy is on fire. Can I subscribe monthly for only $12 with your credit card?” “Mom, this bag of 35 ring pops that I absolutely must have is only $7. Can I buy it? (meaning – I’m putting it in your Target cart.) OMG!!! It is endless. The requests drive me crazy, add up and quite literally make me want to Van Gogh myself so I don’t have to hear them. (Side note, I am not in any way diminishing or making light of Vincent’s depression or mental illness. Only noted for illustrative purposes.) My answer, I had them put their overpriced phones with monthly reoccurring payments, insurance costs and complaints about lost chargers to good use. Shopkick. Fetch. Ibotta. I love them. I find them fun to use. They’re not time consuming, and it’s a great way to earn gift cards or cash back for me, and better yet, for the Wilder girls. Either way, it’s a win for me and my wallet. If you haven’t used these apps, they are really cool. Quick overview. With Shopkick, you keep it open and your Bluetooth on as you shop. You earn points as you walk in (or by) certain stores, and you can earn more points for scanning certain products. My girls love to walk around Target and scan products, and it keeps them busy while I’m shopping, and it keeps them throwing things in my cart. Plus, they are constantly earning $5 or $10 gift cards to places like Target and Ulta. I’ve been using this for a little over a year and have earned $150 in Amazon gift cards. And the girls have earned about 1/3 of that combined. Nice score for them! Fetch. Love this app! You scan your receipts from grocery and big box stores like my beloved Target. The app awards you points for each receipt. BUT! The best thing about this app is that it tracks your spending. I’ve been using it since March, and I’ve spent $5,221,80 – which is approximately 26.27% of my spending. I’m actually surprised it is only that. To date (since March) I’ve earned $75 in gift cards to Amazon. Not bad. And lastly Ibotta. I have been using it for about two years and only regularly for 15 months or so. I found it cumbersome but kept trying since the rewards were decent. They’ve streamlined and simplified the experience and now it is easy breezy lemon squeezy. I’m just shy of $600 in total earnings. My point is, in this world of new tech, new ways to “earn income”, new places to hold disposable income, and a push for financial education and literacy, wouldn’t it be neat to partner with these app and use them as teaching and savings tools for the younger generations? My girls, 13 and 10, a saver and a spender respectively, both enjoy these apps for the same reason – the need/want for spending power and the lack of ways to earn towards it. (without asking mom). How can we as credit unions tie into this “earnings game”? Are there ways we can create partnerships with the Shopkicks, the Fetches, the Ibottas? I would love to see a partnership with Ibotta that gave members the option of splitting the reward between the gift card and a deposit into your credit union youth savings account. Possibly with a percentage bonus earned for reaching a specific number of deposits or reaching a savings amount goal.

Facebook Business Page Update

It comes as no surprise that Facebook has once again changed its formulas. While the analytics are unmatched by any other platform, Facebook strives to continuously improve the user experience. Always in search of the ultimate experience, this update seemed surprisingly late. In this recent update, Facebook announced quite a change for its business pages. Facebook is aiming to eliminate duplicate views on posts in order to show a more accurate depiction of the actual reach your posts are receiving. While this update is actually a good change, companies need to be aware of it so they’re not surprised when they’re reviewing their analytics. In light of this new change, here are a few recommendations for brands looking to audit and assess their true performance on Facebook after the new algorithm change. Set new benchmarks for reach and engagement. The new algorithm was implemented in November 2019. When January arrives, use December’s post reach as a new benchmark to gauge social performance. Otherwise, you would be doing yourself and your brand a disservice. Don’t discount past posts that seemingly received good engagement. Just because the post performed very well under the old grading system, doesn’t mean that it won’t under the new benchmarks. For instance, if you’re sharing an evergreen post you shared in the past as a current #ThrowbackThursday, be mindful of the new grading system. Keep being consistent. The key to a good social media strategy is not only the strategy that’s used but the implementation of the strategy that remains consistent. Whether you’re posting 3 times a week or 3 times a day, be sure to remain a reliable content source. And as always, post once, measure results twice. I’m all about giving bonuses, so here’s a bonus tip. If you want to optimize your social media presence, you need to stay informed. Many aspects of social media are changing; in fact, I would say the one thing about social media that’s consistent is that it’s changing. Therefore, always be looking for ways to optimize and improve, just like Facebook and you will be on the path to being successful at social media. Whether its social media or inbound marketing, Social Media Strategist, Casey, is ready to whip your digital presence into shape. If you’re ready to make strategy at the forefront of your social plan, you can reach her at casey@yourmarketingco.com.

Who Are You Talking To?

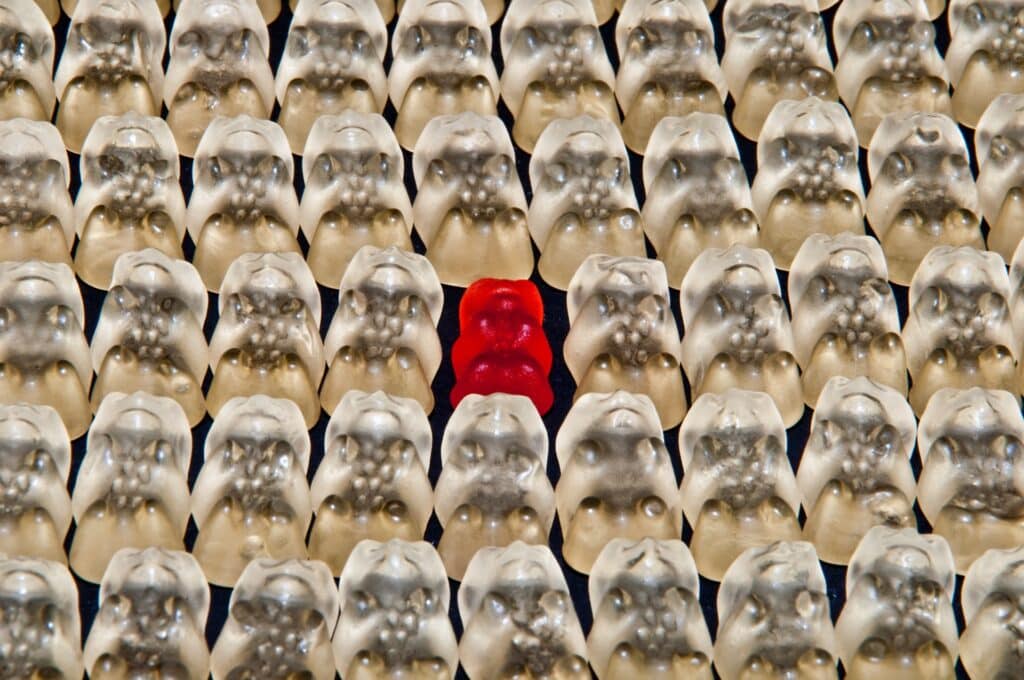

Are you more George Michael or Lady Gaga? Maybe Rolling Stones or Blake Shelton? These can be fun questions to answer, but at the end of the day, it doesn’t matter who you are most similar to. It matters who your members most relate to.Your language and your imagery define your brand. The persona of your credit union needs to be relatable and specific. All too often I hear credit union leaders tell me they want to appeal to everyone they can help. While this approach sounds good in theory, it ultimately waters down your message.If you don’t know who you are talking to, you can’t connect on a deeper level. Surveys have shown that 77% of millennials would rather receive a message from their dentist than their financial institution. I don’t know about you, but I don’t exactly get excited about scheduling my regular cleaning. So why do people prefer to hear from their dentist? Because unlike the finance-related communication, the dental message is specific to them. So how do you get specific with your messaging? First, you have to decide who you are talking to. Who does your credit union serve the best? Is it the millennials who may be getting married, buying a new home, and starting a family? Perhaps it’s Gen Z members who are starting life after college and facing all the demands that lie ahead. Whoever it is, your messaging needs to be tailored to their demographic.I’m not saying you can’t serve those who come to you. If a 55-year-old member comes looking for a retirement fund, of course you’re going to help them find the best option. But when it comes to attracting new members, you’ll be more successful by targeting the people best served by your team. Here are a few questions to help you identify your “ideal member”: 1) What is our strongest offer to members?2) Who needs this solution?3) What media platform does this individual use most?4) What kind of language does this person use to communicate?Marketing can become overly complicated, especially when you consider the variety of platforms and communication styles that are available. It is tempting to try and appeal to the masses and serve everyone you can. But when you try to be everything to everyone, you dilute your message and lose the ability to help those who truly need what you have to offer.Don’t try to be trendy. People see right through attempts to be cool. Think about the genuine relationships you’ve made with members over the years. I would be willing to bet most of them were formed by sitting down with members, discussing their unique challenges, and creating a financial roadmap just for them. Credit unions were designed to serve those who were not served by traditional financial institutions. If you want your credit union to succeed, I implore you to explore your roots and find who you can serve best. Then, once you’ve identified your ideal members, create messaging that speaks specifically to them and connects with their needs.

5 Cents

Put in my…5 cents…? What the what? It used to be 2 cents. When did inflation start affecting sayings? I am certainly more than willing to put in my 2, 5 or even 25 cents – not sure if my opinion is worth that but I’d throw some change in to give my say. Honestly, I usually throw my opinion in for free and without prompting. I was in a team interview a few weeks ago with a potential new Relationship Development Leader, a millennial if you will, looking to join the YMC team. The interviewee said he would always put in his 5 cents. No one said anything, but I thought, “Am I the only that realized how crazy that sounded?” Is it my age? Anyway, of course that sent me over the edge, and I started thinking, “Wow! How times have changed.” I get a bit obsessive over things and my mind runs in many directions quickly. 2 cents. 5 cents. When did this change happen? Was it discussed? Or, did someone have 5 cents in their pocket one day and thought, “Why not? I’ll put in my 5 cents.” What about, “Here’s a quarter call someone who cares?” Should we instead say, “Here’s my cell, text someone who cares?” Credit Unions. We market to so many different demographics and ALL the ages. We talk a good game of driving our average age down, having products and solutions to capture various markets, and listening to our members’ needs. We spend time creating bundles to fully arm our members with financial tools, financial literacy, relationship pricing and so much more. Huge dollars are invested in new technologies, delivery channels, branch environments, staff development and employee benefits. We adjust our language for SEGs, for cultures, for underserved markets. I pride myself on always putting the member first – their experiences, interactions, and relationships. I pride myself on relevant automation and using it to deliver a member specific, perfectly timed communication. 5 cents. That’s all it took. Two words to make me stop in my tracks, obsess, write this blog. Two words that made me think – am I out of touch? Am I delivering the right message with the right language to the right member? My point? I am actually not sure that I have one. But it is making me think and I like that. Pondering ideas. Pondering is like a one-person brainstorming event in my head.Embrace pondering. Strategic planning season. My 5 cents about it? (Since the value has obviously gone up.)When we look to enter new markets or increase penetration among certain age demographics, we must also learn the lingo. The language we used years ago to craft our message might not be relevant today. Two cents. $2 bills (which, by the way, my daughter tried to use at Five Below and was told they don’t accept them). CDs. DVDs. Cassettes. Dare I mention 8 tracks? Stick shift cars. MySpace. Hotmail. Earthlink. Dial up internet. Shoulder pads. Driving to get your own take-out meal. All of these things are irrelevant, outdated. Are our messages outdated? Checking accounts. Do we really need them anymore? And who uses those anyway? Do they still teach children how to draft a check in high school? Unless you have kids and need to send random $10 stipends to the PTA or PTO. Cash. I barely even know what that looks like anymore. But it is dirty, and I can Venmo easily enough. And, if I don’t have it, my kids can’t get it. Waiting 7-10 days for your plastic, your spending power. DAYS? Who waits days for anything anymore? Target, Amazon – same day delivery. SAME DAY. That means under 24 hours. Crazy. Apple instantly delivers your new “card” to your digital wallet and then you have to go into the app to actually request a card to be sent to you. Plastic doesn’t need to be touchable anymore to be useable. Perhaps we need to start turning our messaging. Do our members or potential members care about the nearest ATM to get cash? Will they in another 12 months? Do our members care about checking? My checking account is just a place that my direct deposit goes every two weeks. I don’t think about it – I have my bills on autopay and I take a look at the end of the month in case I have to adjust a payment or pay ANOTHER medical bill. Anyway, the point being my checking relationship is really defined by my debit (or charge) card. Physical plastic? That’s become my backup – I leave cards in the car just in case I run into a store that does not accept me tapping my phone as payment. The days of my losing my card are almost behind me – now, hopefully I don’t lose my phone. One month left in 2019. One month of planning, drafting strategic goals, shoring up marketing plans. Are you doing anything different in 2020? Is your messaging changing?Are you building foundations for the next 3, 5, 10 years when plastic is almost certainly gone? When cash is irrelevant? When your delivery channels have advanced lightyears in just moments. If you aren’t already are you ready to embrace pondering? Brainstorm – project – plan. It’s time.

I Hate Asking for Help

I hate asking for help.I believe manuals are for dummies.I believe in the sink or swim.I believe in the figure it out.I do not listen to directions well. I listen halfway and then think I got the gist of it.I do not take maps. I think I have a photographic memory. Utah. It’s gorgeous. Mountains are awe inspiring. Hikes are amazing, and breathing, well let’s just say it is hard at 8,300 feet above sea level. I blame the high altitude for many interesting decisions over the last several days. Frank will tell you we had an “adventure”. I call it one step away from Naked and Afraid – without the naked part. 3.9 miles of hiking in Park City, Utah – Holly’s Trail. It’s one big traverse they told me (“they: being the front desk staff and my new best friends due to a fantastic upgrade!). Anyway, 3.9 turned into 9 miles turned into us trying to race down the side of a mountain on a ski slope on foot with dusk rapidly approaching. I will say the MAP that we took since I got lost, I mean went on an “adventure”, the day before was really not helpful. Help. UGH. I loathe succumbing to asking for someone to guide me. HELLO????? I KNOW what I am doing. Long story short, we had to call MORE THAN ONCE for help routing our way through the mountain. We even had to send photos to show exactly where we were. How over the top pathetic that sounds, but sadly totally necessary. Help. It’s not just for lost hikers. We all need it sometimes. It’s hard to ask for help. But, a lot of things in life take more than one person. There is no “I” in “team” as they say (different “they” than the hotel staff mentioned above). Our members ask us for help every day. It’s kind of why we exist. To help our members with their finances, to help them save and budget, to help buy a first car or home, to help send a child to college or help with medical expenses. As we head into strategic planning season and make our plans or tweak existing plans, we need help. We need to ask our employees, our partners (vendors), our executive team, for help. Help in defining and reaching our goals; help in strengthening our credit unions; help in creating strategic plans; help in making every member experience exceptional. How can we achieve goals, make differences in our credit unions, make differences in our members lives without help? We can’t. We need to come together to achieve these things. We need to work with each other and ask for help form our peers in making strides, in making advancements, in implementing new technologies, in communicating with our members, in representing your credit unions brand and mission accurately. We are credit union people. We believe in the cooperative.COOPERATIVE. It’s a strong, powerful word that defines credit unions.COORERATIVE. It’s how credit union pull together, share resources, make changes, make advancements, help our members. When we don’t ask for help we are losing out on opportunities. When we don’t ask for help sometimes things take twice as long (or 3 times in the case of the hike). When we don’t ask for help we are only hurting ourselves, or our credit unions, or our members. It’s a lesson I need to learn personally. Put the pride aside, put the manic type A control freak personality aside, put the worry that others might think you aren’t up to task or not understanding what needs to happen. Just ASK. There is nothing wrong with reaching out, for advice, for guidance, for an opinion, for help in growing internally and externally as a credit union, for finding your way back down the mountain. How can we help you this year? How can we help you improve your member experience? How can we help remove obstacles and barriers that prevent your members from achieving their goals? How can we help your staff grow into effective communicators? How can we help you reach your membership goals, loan goals, cut expenses, develop a social media strategy, create or effectively promote your credit unions brand? When you are ready to ask for help, we are here to listen and be part of your team.

What Is a Leader?

What is a leader? The answer is simple. Everyone is a leader. The real question becomes: how good of a leader are you? I was selected for the Future Leaders of YMC in January. Being a boutique agency, we are fortunate to be nimble and provide opportunities for participants to create and execute their concepts in progressing the company forward. Each year, there is an application process which is reviewed and selected by a third party. The participants are given one year to identify a company-wide problem and to provide a solution in the form of a project. The project is implemented and the results are measured. Monthly meetings gauge the progress of the project and what challenges have arisen. Entering the program, my goal was to grow my leadership skills in order to bring out the highest potential in others. I wanted to make a positive impact on the growth of our company. To be honest, I really wanted to learn how to get to the next level in my career. It wasn’t about a title or paycheck, but more so the feeling that I was moving forward in life. You may notice a common theme. There are a lot of “me” or “I” statements in that last paragraph. We are now rounding out the third quarter and my biggest take away is that leadership isn’t about me. Recently, I was in a planning session that generated a great deal of opportunities for discussion. The group was comprised of a board of directors, the CEO, and a mix of staff members. We were rolling along with discussions on how these proposed changes could impact their existing members and serving potential members. There were tons of pros, cons, potential obstacles and possible failures. Every discussion was focused on the member and the credit union. There were no discussions about the departments or how hard it was going to be for anyone. There weren’t any “I” statements and none were reflected in the thought process. The discussion resulted in a solid game plan with a high likelihood of success due to balanced risk and a strategy to tackle the obstacles. Post-meeting, I soaked in a little sunshine and had one of those little “aha” moments. The room had been filled with a mix of corporate levels. Not everyone had direct reports, authority, or title. It didn’t matter. The key was not trying to be a good leader, and it wasn’t about learning the right skills. The key was forgetting ourselves and focusing on the mission and member. When you focus on the mission and the member, you are being a quality leader. Earlier this year, I was honored to be part of a program that teaches learning about the outward mindset. The goal of an outward mindset is to shift your thinking outside of yourself. View each challenge from the other’s perspective and focus on how it relates to the mission.The program involves exercises to examine how the full cycle of communication occurs and finding where you are contributing with an outward mindset. One of the best examples was two people sitting in a chair. When working together, if your chairs are back-to-back, you have the worst communication. If one person shifts directions, it improves. Only when you can both face the same direction, can you be effective. Reading about a concept is one thing but understanding is it different. And this idea suddenly clicked. Making decisions based on the mission and removing yourself from the equation and goals you have is key. Identifying how you are contributing to conflict and stopping those negative behaviors is the only acceptable time to think about yourself. You can’t make leadership happen by trying to be good at it. It’s about practice and letting it evolve naturally, instead of being forced. As Shawna Shapiro shared in a 2017 Ted Talk, “What you practice grows stronger”. I am grateful for what I have learned so far and it’s time for more practice.

Being Relevant Among The Noise

Speaker: Audra Wilder 0-90 minutes Let’s face it. Data is OVERWHELMING! What pieces do you REALLY need to reach your member, your goal, or drive behavior? In this session, we’ll talk about using data and targeting already in your credit union’s environment (core, online and more) to reach your members with specific, relevant messaging that makes them feel SPECIAL. Key Takeaways Book Now