5 Lessons for CEO Growth

4 Inspiring Credit Union Rebrands Download

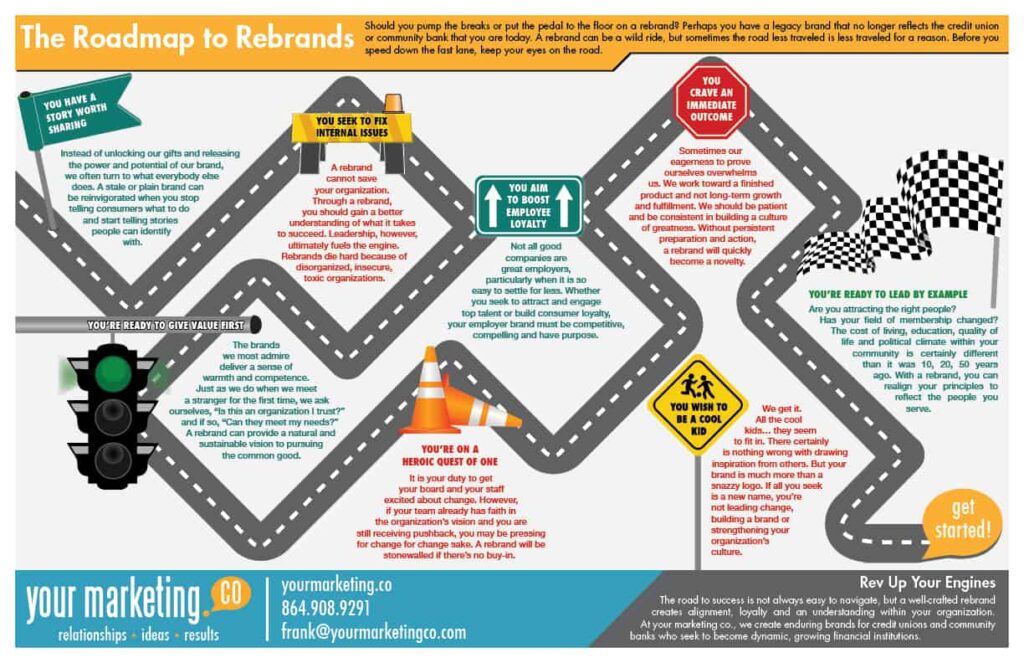

Road to Rebrands Download

Mind The Gap

Flip the Switch Download

Rock and Roll Marketing

How Hispanic Marketing Boosts Membership, Team Confidence and Success!

Credit unions can benefit immensely by serving Hispanic markets. A recent study by the NCUA showed more than 30 million Hispanics who are members of credit unions of a total 60.5 million living in the U.S., according to the Department of Health and Human Services. This burgeoning demographic makes up just 26% of total credit union members, which represents great opportunities for your credit union. So, what can your credit union do to boost its success? For credit union marketing to earn the trust of the Hispanic community, keep in mind the myth that Hispanics, particularly Latinos, are similar in their views and experiences politically, socioeconomically and in numerous other ways: This is not the case. Latinos are incredibly diverse, from South to Central America. Our foods, music, sports, culture, and idioms vary from country to country, and it’s important to understand each of our intricacies to help meet our financial needs. Aside from understanding the diversity of Hispanic culture, Hispanic marketing experts can help your credit union confidently build a strategic plan to help your credit union effectively engage with Hispanic people in your field of membership, implementing productive campaigns through the proper marketing channels. Not only your credit union will succeed by reaping the benefits from a specialized team dedicated to your credit union’s Hispanic outreach efforts, but your team’s confidence will flourish with the proper tools and marketing to support them, providing opportunities for financially centered conversations with Hispanic members. Of the many details to highlight in their native language, the most important is to help them understand that their money is safe and secure with your credit union, even if your institution is not as big as other big banks or renowned financial institutions. Outsourcing your credit union marketing to an expert Hispanic marketing team like Your Marketing Co. is a great way to lessen the burden on your credit union’s marketing team while also attracting new members. As your credit union grows, so will your team’s confidence. Here are some great reasons why your credit union should outsource Hispanic marketing to us: Sound like a good idea to you? Let’s Talk!

Big Tech Making Big Changes That Affect Credit Union Advertising Campaigns

Under the gun from lawmakers and lawsuits, Google’s™ web privacy efforts have made it harder for advertisers, publishers, and data brokers to gather personal data without users’ permission. Google™ will no longer be making data profiles based on users’ activity on Google™, and while this is great for individuals who seek privacy, for advertisers it’s a blow to the face. Third-party cookies that are placed on websites are being phased out, including the ability for third-party sites, like Google™, to track activity upon entering and leaving websites. This could potentially hurt advertisers who want to target competitors’ websites and people in the market for products. The silver lining: If you have a Google™ ad tag already installed on your website, Google™ will still be able to gather data from your visitors and retarget them with your ads. An alternative to a full privacy lockdown was introduced in 2019 by Google™ with the idea of a “privacy sandbox” designed to serve both the privacy concerns of individuals and the need to target user interests for advertisers and publishers. The privacy sandbox is “a secure environment for personalization that also protects user privacy,” said Justin Schuh, a Google™ Chrome engineer. The privacy sandbox is still in progress and has multiple ways it can gather data without accessing the personal details of the user, including a “privacy budget” and Federated Learning of Cohorts (FLOC). Apple® has already announced a similar initiative to promote privacy on its cellular devices. The new iOS 14 will have a feature for users to select whether they give permission to be tracked on all apps. Who will this affect? Advertisers like our credit union clients, of course. Not having data based on individuals’ interests and intent greatly hinders the ability of advertisers to target the right people at the right time. It is great for users who value their online privacy. Facebook® doesn’t entirely agree with Apple® and Google’s™ approach to eliminating data collection. In their recent ad campaign, Facebook® defends the right for personalized advertising in that “Good Ideas Deserve to be Found.” Facebook’s® ad campaign advocates that not all data collected are bad for consumers. In fact, the data that are collected will only benefit people by serving ads that fit a consumer’s interests. The ad promotes helping small businesses to reach the consumer in a more personalized way. So, here’s the bottom line: The privacy updates are happening. They will force advertisers to think outside-the-box instead of relying on data to find interested consumers. Your Marketing Company’s clients may experience increased clicks and lower converted traffic due to the restrictions on personalization capability, but we will grow together and shift paths as we always do. YMC is constantly striving to reach your credit union’s members on the ever-changing advertising landscape. Here are additional resources if you’d like to learn more: Building A More Private Web Building A Privacy-First Future For Web Advertising Good Ideas Deserve To Be Found Facebook Launches Ad Campaign To Defend Personalized Advertising Ahead Of Apple Privacy Change

Maintaining diversity and inclusion in the workplace

“Diversity and inclusion” is a phrase we have been hearing for a while but in the past few years, it’s become an essential part of organizations around the world. We hear diversity and inclusion everywhere from hiring processes, webinars, seminars, workshops to small projects such as community outreaches and more but just how important is it to have an inclusive and diverse environment in your credit union? Maintaining diversity and inclusion in a financial institution such as a credit union is extremely important not only because of the policies and regulations that prohibit a lender from making decisions based on gender, religion, race, age, ethnicity, sexual orientation, education, and/or other attributes but because it takes away from properly connecting and relating to members to build strong long-lasting relationships with them. The lack of diversity and inclusion also makes a credit union’s internal culture weak and feel stuck in old ways. This is why it is important to keep our board members and leadership team accountable for making sure our credit unions continue evolving and become diverse, inclusive, and have tools to keep with these changing times. There are two main reasons why it’s important to maintain diversity and inclusion in the workplace to reach Hispanics: The first reason has to do with a credit union’s internal culture, the way it’s defined is by everyday decisions, the leadership team, board members and their priorities, focus, and what they allow other staff members do. Diversity and inclusion are necessary to shape the internal culture of an organization and search beyond our own needs and priorities when reaching the communities we serve. When it comes to making important decisions on what new products, services, or new campaigns to launch and implement is important to hear different perspectives, where age, cultural background, race, and others play a big role. Hearing from a board member that moved from a Latin American country and understands the struggles and the hardships of moving to a different country, learn a new language, and learn a new financial system will help the credit union redirect itself and take into consideration other solutions for Hispanic members. The second reason why it is critical to maintain diversity and inclusion in the workplace is that this is key to understand and better serve the members of our Hispanic communities. It allows credit unions to continue implementing solutions and resources that will help members reach their financial goals. The United States has become an extremely diverse country, more so in the past few decades, and the need to open the field of memberships to larger groups and include Individual Taxpayer Identification Number (ITIN) lending to its solutions has become apparent. If a Latino member comes into your branch and does not feel welcome, embraced, or related to, they will eventually have a hard time trusting the staff and the financial solutions that are been provided. Would a Hispanic member feel welcome coming into your branch, searching your credit union’s website, interacting with the call center, or simply applying for a loan? If the answer is no, feel free to reach out to us and we can help you in the process to make your credit union a second home for the Hispanic community.

Hispanic Acculturation & Its Impact on Products & Services Consumption

The difference is vast between acculturated and un-acculturated Hispanics, and the impact it plays when it comes to decision making is crucial while choosing a primary financial institution. Maintaining their Latin culture is very important to Hispanics who move to other countries. Latinos do more than just assimilate into the American culture; they acculturate to fit in and adopt a complementary set of cultural habits in the United States. Acculturation is a process that doesn’t happen overnight, and many Latinos who come to the United States seeking out the American Dream spend years trying to absorb and connect with the American culture, depending upon their level of education, assimilation, support groups and location. That includes where they bank. The level of acculturation is based on education, socioeconomic status and the time spent living in the US. In other words, where you come from and the time living here in the U.S. play a big role in decision making to acquire products and services from credit unions. Some cities or regions have larger Hispanic populations, which sometimes can make it easier for Latinos to navigate the first few months but more difficult to learn English and get familiar with the American culture. Then companies located in those areas must find better ways to bring Latinos in to use their products and services. The difference is vast between acculturated and unacculturated Hispanics, and the impact it plays when it comes to decision making is crucial while choosing a primary financial institution. Acculturated Hispanics are said to be bicultural. Even the newer generations born in the U.S. maintain a high level of Latino culture in their lives. Becoming fluent in another culture takes time and dedication, making it much easier for credit unions to reach a bicultural person than a monocultural person. Credit unions will find it easier to market to bicultural Hispanics because they tend to have a higher level of education, less of a language barrier and enough knowledge about the American culture and finances. Credit unions marketing to bicultural Hispanics still need to understand that even though they are bicultural, it doesn’t mean that their primary culture is forgotten. Your credit union will have greater success if you accommodate your internal organization to meet Hispanics’ cultural expectations. By contrast, monocultural Hispanics are usually Latinos who are just beginning their life here in the U.S. Latinos who moved here at an older age tend to stay monocultural as it becomes harder for them to learn a new culture with all the intricacies tied to it. They also tend to lean on their children and family members to help them navigate processes and financial culture in this country, which makes it harder for them to connect with the American culture. This is why is important for credit unions to not only drill down into the marketing of products and services provided to Hispanics, but also to work on the internal culture of the organization to provide better service and make Hispanics feel at home when they visit your branch, website, mobile application or call your member service center. While serving Hispanics is often generalized that does not mean they all want and need the same things or respond in the same ways. Credit unions must understand the different aspects and levels acculturation to provide the right marketing, products and services to help members make the sound financial decisions and make them feel welcomed into the credit union.