The decorations have been packed away. The leftovers are gone. All that is left of Christmas 2020 are the memories… and the credit card statements rolling into mailboxes one by one.

According to a pre-holiday survey by CreditCards.com more than half of cardholders who already carry credit card debt (57%) said they would add to it for the holidays. With an average APR of more than 16% – and 78% of cardholders saying they wouldn’t be able to pay off their balance in full after the holidays – opportunities abound to create a win/win situation for your credit union and members.

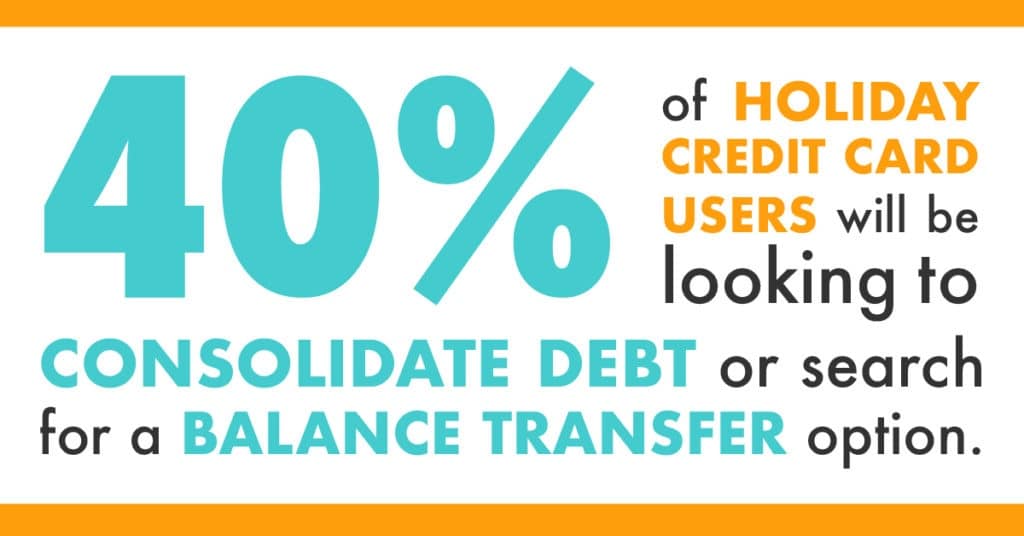

In fact, according to MagnifyMoney, 40% of those people are going to be consolidating debt or searching for a balance transfer option to help undo the financial damage they’ve inflicted on themselves through the holidays.

Beware: Yours is not the only financial institution with this marketing intel. Those same credit card companies (like Chase, Citi and Capital One) have already launched their 0% interest promotions, so how can you compete? Here are a few tips:

- Target! Based on my experience, it’s a good bet your credit union has many members holding your credit card without a balance or a very low balance. Pull an email list of these members and talk to them directly. Show them the math in your marketing to demonstrate the benefits of consolidating balances onto your credit union’s credit card. Don’t forget to add in the emotional value proposition as well.

- Target again! Consider all the members who don’t have your credit union’s credit card, but you would gladly give one based on the data your credit union already has. They’ve been a loyal member for a few years, you’ve already extended credit via a car loan or personal loan, so why not a credit card? Pull this email list, too, and target them with a credit card offer.

- Move beyond email! Use those same email lists to target those members on social media. Upload the lists to Facebook and send that same message for more frequency and even run look-alike campaigns to attract new members with that same offer.

- Cross-sell your hearts out! This is the time for your frontline to shine. Train them to ask open-ended questions and take the financial temperature of the members they serve. While most members don’t have the time to sit through a sales pitch at the drive-thru or teller line, funneling those opportunities to your loan department will yield some warm leads for follow up.

- Don’t forget other solutions! Perhaps your credit union doesn’t offer credit cards? Educate your loan officers to be solutions-based. When they ask the right questions to get to the root of the member’s problem, and they can identify other solutions for that member beyond product pushing. HELOCs, personal loans, auto refis or cash-out auto refinancing.

‘Tis the season to put our credit union words into action. It does no good just telling people that credit unions are people helping people; we must back it up with action! And now is a great time to do that. As Capital One spends millions asking people ‘what’s in your wallet,’ Your Marketing Company asks one simple question: What’s in your Q1 marketing plan?

If this all sounds well and good, but you’re finding yourself without the resources to dive deep into marketing strategies for 2021, Your Marketing Company can help. We have room to accept one new client into the YMC family before Q1 ends, and we would love for it to be you! If you’re ready for change and success in 2021, reach out to me at Bo@YourMarketingCo.com and let’s start with a conversation.