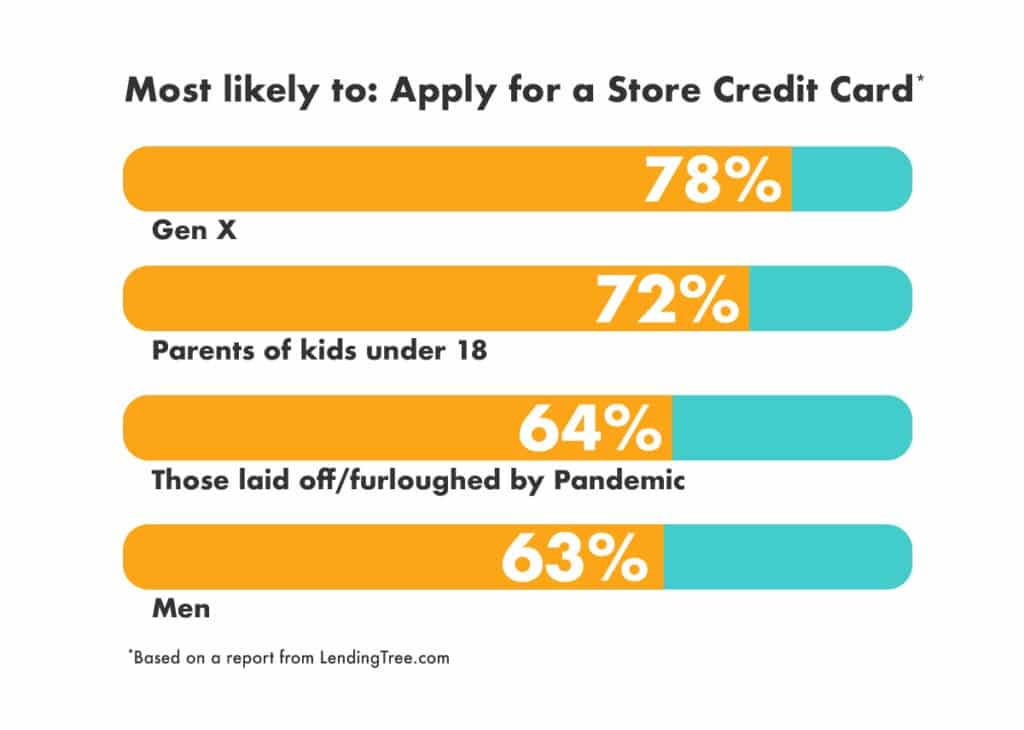

An astonishing 44% of Americans plan to apply for a store credit card this holiday season, according to a new report from LendingTree. That’s up from 32% in 2019 and 24% in 2018.

However, of those same people surveyed more than half (56% to be exact) say they’ve regretted getting a store credit card in past experiences.

So, why would they do it all over again?

Lack of knowledge about their options and that falls directly on credit unions for not doing a better job of educating consumers on our value proposition.

Here’s how your credit union marketing can win the holiday credit card game this year:

The average APR for a new store credit card is 24.24%. While that’s down from 25.41% in 2019, thanks largely to Federal Reserve interest rate cuts, it’s still higher than the rate on your credit union credit card.

I smell an incredible opportunity for credit unions to be the hero this holiday season! Even for those credit unions not offering credit cards can beat those rates with special holiday loans!

But wait, there’s more. Nearly half (49%) of those with store credit cards are carrying balances.

Now is the time for your credit union marketing message to ramp up and reach out to consumers offering them an alternative, either for a new credit card or balance transfer.

Knock the wind out of the big-box stores and make sure consumers know that your credit union has a better alternative to those high interest rates on the store credit cards this holiday season. And if you didn’t reach them in time, a balance transfer can help those who have already fallen prey to those store cards.

Wondering what to do with this knowledge? Struggling to keep up with your credit union’s marketing needs? Let Your Marketing Company help. For more than a decade, our credit union marketing firm has partnered with hundreds of credit unions to help them realize unprecedented growth using our unique, time-tested action plan. Email bo@yourmarketingco.com and start growing your credit union today.

Comments