Our Work

From record-breaking loan growth to award-winning website overhauls, Your Marketing Co. helps credit unions think differently and thrive. On this page, you’ll find proof in action: inspiring success stories, powerful spotlights, and digital transformations that are more than skin deep.

Whether it's Strategy, Culture, or Clicks,

These are the stories credit unions are Proud to Share.

proof In the Numbers:

stories of strategic growth

From doubling monthly lending to achieving multi-year asset growth, these written stories dive deeper into the credit unions that chose to think differently. Learn how bold leadership, smart partnerships, and strategic execution with Your Marketing Co. helped these institutions overcome uncertainty, compete with confidence, and deliver meaningful results for their members and communities.

YMC's Outsourced Strategic Marketing is like having a CMO and entire marketing team on YOUR team, for less than hiring one marketing person. We bring clarity and action to the vision you have for your credit union while eliminating barriers to growth. We will help your credit union accomplish strategic goals to educate, engage, and retain the next generation of credit union members.

Auto Loans Grew by 39%.

Driving Loan Growth and New Membership During a Competitive Auto Market

The Challenge

Auto loan competition continues to intensify. Rising interest rates, aggressive dealer financing, and fintech lenders have made it increasingly difficult for credit unions to win both loan volume and new members—especially during the fall and holiday months.

This credit union needed a campaign that could:

-

Drive meaningful auto loan growth

-

Attract new members, not just refinance existing ones

-

Perform better than the prior year’s results during the same seasonal window

The Strategy

Rather than running a generic auto loan promotion, the campaign focused on a clear value-driven offer designed to appeal to couples and households making vehicle decisions together.

The Power Auto Loan campaign was built to:

-

Position the credit union as a competitive, relationship-first alternative to dealer financing

-

Tie loan growth directly to membership growth

-

Leverage branch teams to support and convert new member opportunities

The Execution

Key components of the campaign included:

-

A focused promotional message centered on joint decision-making and shared financial benefit

-

Alignment between marketing, branch teams, and lending staff

-

Clear internal tracking to separate total loan volume from new-member-driven results

This ensured the credit union could evaluate not just loan growth—but quality growth tied to new relationships.

The Results

The campaign delivered a significant year-over-year lift compared to the same period in 2024.

2025 Campaign Performance

-

156 auto loans funded

-

$5,000,000+ in total loan volume

-

45 loans from new members

-

$1,000,000+ in new-member auto loan volume

Branch-level impact showed particularly strong performance in Schaumburg, which generated 26 of the 45 new-member auto loans, followed by Houston (14), Nashville (3), Medstar (1), and Owings Mills (1).

2024 (Same Timeframe)

-

112 auto loans funded

-

$3,202,555 in total loan volume

Why It Worked

Several factors contributed to the success of this campaign:

-

A clear, differentiated offer instead of rate-only messaging

-

Intentional focus on new member acquisition—not just loan churn

-

Strong coordination between marketing strategy and branch execution

-

Seasonal timing aligned with real consumer buying behavior

The Takeaway

Auto loan growth doesn’t happen by accident—especially in a crowded market.

This campaign proves that when credit unions align strategy, messaging, and execution, it’s possible to drive meaningful loan growth and attract new members, even during highly competitive periods.

Driving Loan Growth and New Membership During a Competitive Auto Market

In a crowded auto-lending market, standing out takes more than a low rate. Through a focused Power Auto Loan campaign, First Eagle FCU made borrowing simpler and more meaningful for members—and it paid off. Auto loan volume climbed to $5.5M, with new members accounting for nearly $1.8M in funded loans. It’s growth driven by clarity, coordination, and putting people first.

how uccu grew loans by 48%

In a time when rising costs make life harder, United Community Credit Union is making it easier. With flexible loan payment options and real member givebacks, UCCU is helping families stay on track financially... and it’s working. Loan volume is up 48%, with more members discovering a credit union that leads with heart and strategy. It’s community banking done right.

Strategic Marketing Fuels 48% Loan Growth at UCCU

Amid Rising Costs, Credit Union Eases the Inflation Burden

QUNICY, ILL. – Serving mostly rural areas with limited access to services and infrastructure in Missouri and Illinois, United Community Credit Union is playing a role in building more sustainable, vibrant communities. In July, the $118 million credit union reported a $4.1 million increase in loans year to date, outpacing last year by 48.2%.

“We had big loan growth in January, and it has never stopped,” said CEO Sarah Distin. “That’s very unusual.”

She credits the growth with giving members the flexibility to choose their own due date and payment schedule in today’s environment. Inflation has continued to erode the purchasing power of individuals and families, making it increasingly difficult to afford necessities like groceries, housing and healthcare. As prices for everyday goods and services rise, many people find their wages aren’t keeping pace, leading to a squeeze on household budgets.

UCCU allows its members to align their payments with their cash flow, reducing the stress of meeting rigid deadlines, especially when expenses fluctuate due to rising costs. Paying weekly, or according to one’s preference, can help with managing budgets, avoiding large lump-sum payments that might put a strain on one’s finances.

In March, UCCU paid more than $125,000 in interest rebates and bonus dividends to its members in the form of deposits to savings accounts. It’s a reminder that credit unions are supposed to be “not for profit,” Distin said.

“There are other larger credit unions where their return on assets are insane. Their philosophy is to be a bank,” she said. “We felt it was the best time to give back to our membership.”

UCCU steps in when members struggle to pay their bills. Where other financial institutions refuse to make small dollar loans, the credit union offers quick approval and funding online. Members can also refinance their auto loans from another lender and save up to 2% annual percentage rate.

The credit union’s current auto campaign, “Inflation Got You Down,” created by Your Marketing Co., uses the visual metaphor of an over inflated tire about to bust to symbolize the financial strain many are feeling due to inflation. Just as a deflated tire makes it difficult to move forward, inflation makes it hard for people to keep their financial lives on track.

“United Community Credit Union is firing on all cylinders, consistently expanding their reach and deepening member relationships,” said YMC CEO Bo McDonald. “Their ability to successfully market themselves has led to steady growth in loan origination and increased wallet share – expanding their reach and deepening member relationships.”

In June, UCCU broke ground on a 9,000-square-foot headquarters that is centrally located in the town of Quincy, Ill. When it opens in 2025, the new headquarters will double its existing space, have three drive thru lanes with an ATM that accepts deposits, and undergo technology upgrades that will better serve staff and members.

“People are discovering us,” Distin said. “We’re getting our name out there, and when we get a new member, we’re matching the service they expect. In today’s world, people find that valuable.”

co-ceos driving culture

& crush loan goals

What happens when resilience meets strategy? Roanoke Valley Community CU’s co-CEOs Pam Duke and Lauren Whitmire are proving that shared leadership can drive both heart and high performance. With $5.5M in new loans and a reenergized staff culture, RVCCU is thriving in a market where others are consolidating. Add in the strategic boost from Your Marketing Co., and this is a blueprint for modern credit union success.

New Co-CEOs Lead with Vision and Resilience

Committed to a Succession Plan, Roanoke Valley Community FCU is Thriving

ROANOKE, Va. – Roanoke Valley Community Credit Union has kicked off 2024 on fire, boasting an impressive $5.5 million in new loans under co-CEOs Pam Duke and Lauren Whitmire. This remarkable start follows a stellar 2023, where the $103 million credit union achieved a 37.2% increase in loan growth, far outpacing peers in terms of loans, capital growth, net interest margin and return on assets.

“Our numbers are telling you where we are going with this team,” Duke said. “We’re definitely not going backwards. It takes a special team to make it work.”

Duke and Whitmire were named co-CEOs in November 2023 after the sudden departure of the previous CEO. Duke, who has served as a CEO at another credit union, has been with RVCCU since 2010. Meanwhile, Whitmire, who joined in 2012, served two stints as an interim CEO at Roanoke County Schools Employees FCU before it merged with RVCCU.

With Duke eying retirement after a distinguished career, and Whitmire poised to grow into the role of CEO, this leadership structure offers a seamless transition plan. Duke’s wealth of experience and deep understanding of the credit union’s operations provide stability and mentorship, while Whitmire brings fresh energy and a forward-thinking perspective. This combination leverages their individual strengths, ensuring that RVCCU benefits from seasoned wisdom and creative solutions simultaneously.

A component to the credit union’s success was bringing back Scott Ruhlman as chief operating officer. He previously served as RVCCU’s director of lending from 2005 to 2016, and most recently worked for another credit union for the past eight years.

“As far as the staff, it’s a very different culture, a different mindset, and we have different goals,” Ruhlman said. “Before it was more of a transactional environment and now it’s more personable and engaging. And that environment starts from the top and comes down. Pam and Lauren set that atmosphere and it flows downhill to the frontline staff.”

Employees are not just workers, but value being part of a dedicated team, Whitmire said. The credit union is fully staffed and have begun to implement universal banker roles where the frontlines can open accounts, handle cash transactions, sell/cross-sell products and services, as well as resolve issues.

Recently, the entire RVCCU team surpassing a monthly loan goal that triggered a $300 or more incentive per employee. New loans total $5.5 million of a $10 million year-end goal, taking its loan-to-share ratio from 62% to 69%. The goal for year’s end is 72%.

Instead of relying on investments, RVCCU is investing its money into its membership by way of lending, which the leadership team says is true to the purpose of credit unions.

“We’re finally bringing everyone back together and making it a more inviting, more fun place to work,” Whitmire said. “Overall, the staff has a great frame of mind every day. They realize they are important here and that they benefit this place by being here. They matter!”

The impressive loan growth can also be attributed to the strategic marketing initiatives implemented by Your Marketing Co. By effectively reaching out to potential members and highlighting the credit union’s unique value proposition, RVCCU has successfully attracted greater loan applicants and increased its loan portfolio.

RVCCU’s success comes in the wake of mergers and acquisitions in the Roanoke area from both banks and credit unions. However, bigger is not better, the team says. Simultaneously there’s a movement to “leave no credit union behind,” and RVCCU is stronger as it’s ever been.

“We are the perfect storm,” Duke said of the leadership team. “We all have so much to give in different areas, and we all bounce ideas off each other extremely well. I couldn’t have picked a better team.”

In January, RVCCU engaged with on-site staff training with Your Marketing Co. The staff learned how to become an irresistible teammate through the art of communication, empathy and active engagement. The credit union also uncovered key elements that define a healthy culture.

“They were so complimentary after the staff training,” Whitmire said. “They’ve said they got the most out of it than they have ever gotten from staff training. We’re making an effort to meet the goals that we want to meet.”

Whitmire adds YMC has made the leadership team stronger, too.

“YMC has been very supportive, willing to help in any area they can possibly help,” she said. “They are super flexible and understanding.”

from stalled to soaring

under new leadership

When Steve Foley took the reigns ar Bragg Mutual FCU, the $55M credit union faced an uncertain future. Fast forward four years and Bragg Mutual has doubled its assets, achieved 20%+ annual loan growth, and earned national recognition. Discover how bold leadership, smarter lending, and a trusted marketing partner helped turn a struggling institution into a thriving success story.

Bragg Mutual FCU Transforms for Growth

“YMC understands credit unions.”

“We needed to reorganize how we did business, and we needed to keep it logical,” Foley determined.

Over his four years with Bragg Mutual, the credit union made significant changes by focusing on growing the auto and real estate portfolio, increasing training to improve member service, introducing cross-selling, and diversifying its product and service offerings.

As a result, Bragg Mutual has grown to $110 million in assets and averaged in excess of 20% annual loan growth. The credit union’s current ROA stands at 1.01%, double its peer average. In 2022, Foley was also named NAFCU’s CEO of the Year for credit unions with less than $250 million in assets.

“We’ve positioned ourselves for growth and that’s where we’re seeing fantastic numbers,” Foley said. “My best advice as a CEO is to know where you want to go and examine whether you have the right people to get you there.”

As part of Bragg Mutual’s reorganization, Your Marketing Co. joined the team. The credit union previously had a piecemeal arrangement with a non-credit union focused agency. “Your Marketing Co. collaborated with the Bragg Mutual team to develop a plan, and then executed,” Foley explained.

“YMC understands credit unions, takes the time to understand an individual credit union’s situation and stays in constant contact to ensure the credit union has the best possible chance for success. We got a whole team for the cost of one person, and they’re really good at what they do,” Foley said.

Steve Foley, a first-time CEO at Bragg Mutual Federal Credit Union, walked into a tough situation four years ago. The then-$55 million credit union needed a makeover, both financially and organizationally.

“A lot of smaller credit unions are merging away,” Foley said. “We had to decide: Did we want to maintain the status quo, or did we want to move forward?” Forward, the board decided.

When Foley came to Bragg Mutual, payday loan alternatives were the credit union’s bread and butter. However, the credit union could not scale and grow on small loan products and relationships. The credit union had experienced rapid loan growth, but that growth plan was flawed due to the lack of lending experience in the senior management levels. Personnel changes were made, and Foley was hired several months later. He then began reorganizing management and taking the credit union back to basics to meet members’ banking needs.

bold choice: grow or merge?

they chose to Fight

In 2014, Inspire FCU stood at a crossroads: merge or fight for a future. Under Jim Merrill’s leadership, they fought and won. Growing from $83M to $300M in assets without a single merger, Inspire’s story proves that mid-sized credit unions can thrive with the right strategy, bold decisions, and the right partners like Your Marketing Co. This is the blueprint for sustainable credit union growth.

Inspire CEO: Our story shows there is a path for growth.

“YMC can work by our side; they’re not just order takers.”

“Fear of failure can bring people to a fight or flight moment. Inspire chose to fight,” Your Marketing Co. CEO, Bo McDonald, observed. “That’s what makes the credit union, the board and Jim and his team true leaders.” Merrill explained that it’s critical to have the right team in place, build a culture that emphasizes employee buy-in and community, and truly understand the market your credit union is attempting to serve.

“We had a very vanilla portfolio,” Merrill said. “We didn’t have the products and services that positioned us for growth nor to serve our community.” To hone Inspire FCU’s member focus, the credit union expanded its product offerings and added staff from the community, while making the strategic decision to outsource many of the credit union’s back-office operations and processes, as well as IT, the call center and marketing. Leveraging partners who can perform certain elements of the business better than the internal team is critical for small- to mid-sized credit unions, he added, which is why Inspire FCU reached out to Your Marketing Co.

Brian Phillips, Inspire FCU Chief Revenue Officer, said the credit union formerly used YMC, tried a different agency that was not as versed in credit unions and brought marketing in-house. But now Inspire FCU is back because of YMC’s creative and strategic thinking, knowledge of credit unions and credit union marketing.

“Your Marketing Co. can work by our side; they’re not just order takers,” Phillips said. “We have excellent strategic discussions, which translate to better execution and results.” Merrill emphasized, “We never look for vendors. We look for partners. Vendors cause headaches while partners help you grow because you have a vested interest in each other.”

When Jim Merrill arrived as CEO of Inspire Federal Credit Union in July 2014, the credit union was $83 million in assets with $50 million in loans outstanding.

The board was determining whether it should merge or take a chance to find a leader to help the credit union grow and remain relevant. The board chose the latter.

Today, Inspire FCU stands at $300 million in assets and more than $200 million in loans outstanding. All the growth has been achieved strategically and organically without the boost of any merger. “We hear so many times how difficult it is for small- to mid-sized credit unions to grow,” Merrill said. “Our story tells all the similarly sized credit unions that there is a path.” He added that it requires taking on a little bit of risk, a lot of hard work and being able to make tough decisions—things that some have not been willing to do.

how Coastline FCU Doubled

Lending in just 3Months

No marketing department. No clear ownership. That was Coastline FCU, until Your Marketing Co. stepped in. With a focused plan and fresh ideas, the $146M credit union doubled its monthly lending in one quarter and reversed membership decline. Strategic marketing isn’t just about campaigns — it’s about creating consistent growth, one bold move at a time.

$146M Coastline FCU Doubles Monthly Lending in One Quarter

And Grows Membership with Strategic Marketing Help from YMC

The results following the credit union’s partnership with Your Marketing Co. have been remarkable. In December, Coastline FCU was making about $750,000 a month in new loans. Each month that figure has jumped through March, when the credit union made $1.4 million in loans—nearly double the loans it had been making just a few months prior. The goal had been was to hit $1.3 million in loans per month by the end of the year!

The credit union has been running a variety of marketing campaigns aligned with its brand, not just for loans. For example, in April, Coastline FCU promoted Swipe to Win in which the credit union paid for five card swipes up to $50 in face value per member. Another program, Hit the Gas, Get the Cash, featured $100 to borrowers for a car loan of at least $10,000, and another $100 if the member added direct deposit and a checking account within 30 days of the loan. Coastline FCU grew members by 2.18% as of March 2023 compared to negative membership growth at the same time in 2022.

“There are many people out there saying that a $146 million credit union is no longer viable. Coastline is a prime example of how wrong those so-called experts are,” Your Marketing Co. President/CEO Bo McDonald said. “Smaller credit unions have options other than merger. Strategic planning, branding and marketing, plus a little elbow grease, can help credit unions survive and thrive to uniquely serve their individual memberships for years to come.

Coastline Federal Credit Union never had a single person focused on marketing; the responsibility was spread among several people with no one truly owning it—nor the results. Adding Your Marketing Co. into the mix has created that focus, simplified operations and delivered strong results.

“Having a dedicated, consistent marketing plan has been the key to our success,” Coastline FCU President/ CEO Michael Lebanowski explained. “It’s been nice and refreshing to not have to scramble to come up with campaign ideas every month or so.”

Susan Stanton, Administration Director for Coastline FCU, added, “Delaney Walker, [Your Marketing Co. Marketing Strategist] is easy to work with. Her team brings ideas and really collaborates with us to ensure our best possible outcome.”

In the News:

Real Credit Union stories, real results.

When bold leadership meets the right marketing strategy, amazing things happen. People take notice. From mission reinventions to post-pandemic comebacks, these credit unions have been featured on industry podcasts for their transformative journeys with Your Marketing Co. Tune in to hear firsthand how purpose-driven branding, strategic planning, and marketing execution are helping credit unions grow, serve, and thrive.

YMC's Outsourced Strategic Marketing is like having a CMO and entire marketing team on YOUR team, for less than hiring one marketing person. We bring clarity and action to the vision you have for your credit union while eliminating barriers to growth. We will help your credit union accomplish strategic goals to educate, engage, and retain the next generation of credit union members.

Columbine FCU ditched its old mission

What happens when a credit union reinvents itself from the ground up? At Columbine Federal Credit Union, bold leadership met authentic values to rewrite their mission, and the results speak volumes. Discover how this shift is enhancing member service, powering small business lending, and building long-term relevance in today’s evolving financial landscape.

How a $60m credit union beat the odds

Can smaller credit unions outperform industry giants? Great Meadow FCU says yes, and they have the numbers to prove it. With help from Your Marketing Co., they launched “Roots and Sky,” a high-yield checking strategy that skyrocketed loan growth, boosted shares, and doubled ROA. This is how strategic partnerships fuel real credit union success.

Healthshare: from setback to lending surge

Post-COVID lending challenges hit many credit unions hard, but HealthShare Credit Union fought back. CEO Genice DeCorte partnered with Your Marketing Co. to rethink their strategy, rebuild member trust, and reignite loan growth. It’s a powerful story of resilience, renewal, and the right credit union marketing strategy at the right time.

Websites that tell your story

We design digital experiences that reflect who you are and where you’re going. Whether it’s honoring a legacy, refreshing a brand, or enhancing user experience, our websites connect tradition with technology. We specialize in blending clean design with strategic functionality so your credit union can engage members, drive growth, and stand out with confidence in every click.

Vicinity Credit Union LAUNCHES NEXT-GEN WEBSITE

From its roots in a Chicago high school to a future-focused digital hub, Vicinity Credit Union is redefining local banking. With a bold new name and a smart, ultra-responsive website designed by Your Marketing Co., Vicinity is making banking simpler, faster, and more personal for every neighborhood it serves.

Digital Makeover THAT HONOR ITS ROOTS

When tradition meets innovation, great things happen. With a fresh, intuitive website designed by Your Marketing Co., N.E.W. Credit Union now offers a modern, mobile-optimized experience that makes banking easier for members while staying true to its Wisconsin roots. From faster navigation to personalized financial tools, the website reflects the credit union’s commitment to community, clarity, and connection.

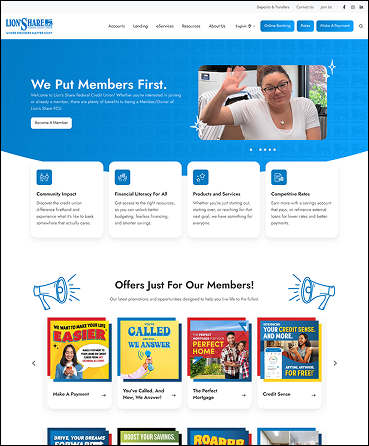

Fierce Loyalty Meets FIERCE DESIGN

Lion’s Share – built on a legacy of serving Delhaize America employees (Food Lion) – now roars online with a bold new website by Your Marketing Co. The revamped platform blends powerful visual identity with seamless navigation, member-first tools, and fully bilingual access (English & Español). It's all designed for the pride they serve.

A NEW SITE THAT'S Easier, Friendlier, Smarter

Serving postal workers across California since 1933, PostCity has always been about loyalty. Now, with a website crafted by Your Marketing Co., they’ve brought those values into the digital age. The upgraded platform is intuitive, mobile-responsive, and rich with member-focused tools – all wrapped in a design that reflects their proud postal heritage and commitment to financial wellness.

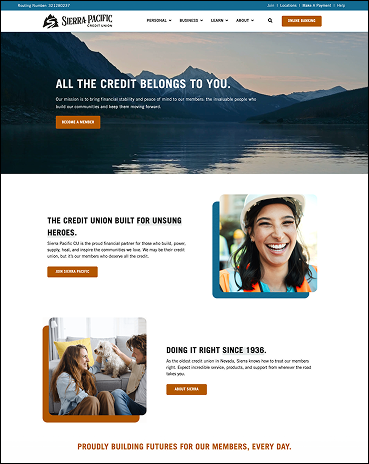

Sierra Pacific DEBUTS BOLD NEW LOOK - AND UX TO MATCH

Nevada’s first credit union, with roots stretching back to 1936, embraced the future with a game-changing brand transformation – including a more adventurous color palette and fresh messaging – then brought it all to life in a user-friendly, performance-driven website. The new site showcases their values, elevates member experience, and lays the foundation for continued growth with a modern identity built on trust.